|

Financial Analysis of DMIC Project

General

It is estimated that implementation of DMIC Project requires an investment of US$90Billion for developing projects that can be implemented through Public Private Partnership (PPP) and for projects that need to be developed through budgetary resources. Broad assessment indicates that there is a potential to implement projects, worth 75% of the estimated overall investment, through PPP.

A special purpose company, Delhi Mumbai Industrial Corridor Development Corporation Limited (DMICDC), envisaged for undertaking planning and project development activity for successfully implementing DMIC Project, incorporated on 7th January, 2008 with 49% equity stake by Government of India and 51% from the financial institutions. Moreover, an Apex Authority was also constituted with Union Finance Minister as Chairman, other cabinet ministers and six chief ministers of DMIC states as Members to monitor the implementation of DMIC.

Accordingly, implementation of DMIC requires adequate funding sources for carrying out project development activities for various infrastructure projects as well as to support day to day functioning of DMICDC.

Based on the activities that are already initiated, as part of Phase-1A, (viz. preparation of perspective plan for DMIC Region and development plans with feasibility studies for six investment nodes) and project development activities (viz. feasibility studies, bid process management, incorporation of special purpose companies) that would need to be carried out for early bird projects, it is estimated that there would be a requirement of INR 100Crore for envisaged project development/preparatory activities of Phase-1A of DMIC project during 2008-09.

Accordingly, following sections discuss about the possible funding pattern for undertaking project development activity, various cost streams (operational expenses, cash flow for project development, cost of loan servicing/ commercial borrowings etc, returns to equity contributions etc) and possible revenue streams for strengthening (or) sources to ensure financial sustenance for DMICDC.

Funding Pattern for Project Development

Successful development of various initiatives as part of DMIC requires undertaking requisite project preparatory activities such as preparation of perspective plan/ comprehensive regional development plan for overall DMIC region, master plans/ development plans for various investment nodes, detailed feasibility assessment and environmental impact studies for various infrastructure projects identified for development through Public Private partnership and for preparation of legal/contract documents to identify entrepreneurs to implement such projects.

Project Development Fund

Considering the requirement to ensure uninterrupted availability of funds for various project development/preparatory activities, the DMIC Project Outline, approved by Government of India and Government of Japan, envisaged setting up of a Project Development Fund (PDF), referred as DMIC-PDF, by raising at least INR 1000 Crore funds (US$250Million). The DMIC PDF would be used as a Revolving Fund specifically for undertaking project development activities viz. identification of projects, preparation of feasibility reports/ technical studies/environmental impact assessment studies, preparation of legal/contract documents for setting up special purpose companies etc.

Brief Concept of Revolving Fund

In India, the concept of revolving Project Development Fund has been a popular and widely used mechanism to fund the project development activities for implementation of infrastructure projects through Public Private Partnership (PPP). Successful entrepreneurs/developers, identified through transparent bid process mechanism, would reimburse the expenses incurred towards respective projects that are being executed through public private partnership. In the interest of the speedy implementation of the DMIC, the PDF may fund unviable projects. However, expenses for such projects would be reimbursed to the PDF by respective central/state government agencies.

It is important to note that funds to the Project Development Fund can be raised through a combination of debt and equity. The contributors/ lenders to the PDF may include Governments of India and Japan, respective state governments, Multilateal Agencies, Financial Institutions, Commercial Banks as well as FIIs.

Accordingly, during the third task force meeting at Tokyo in July, 2007, representatives from Government of India and the Japanese Government discussed in detail regarding the setting up of Project Development Fund (PDF). The Indian side stressed upon developing projects by setting up the PDF with seed money and offered to the Japanese side an opportunity to provide funds for the PDF as a symbol of its commitment and partnership in developing the DMIC project successfully. Both sides have agreed to continue discussion on the framework for contributing to Project Development Fund.

Governments of India and Japan have subsequently undertaken several rounds of discussions at various political and administrative levels to evolve a mutually agreeable framework for the Project Development Fund. Government of Japan expressed its interest to make equal contribution, as Government of India, by offering US$125 Million, in tranches, as untied loan of Japan Bank for International Cooperation (JBIC). A framework is being finalized in this regard, in consultation with METI, Government of Japan. Initially US$75 million shall be taken up from JBIC for DMIC project.

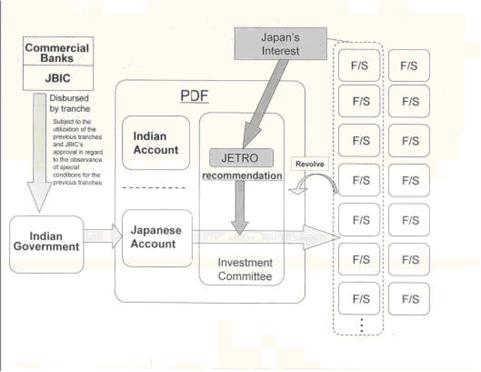

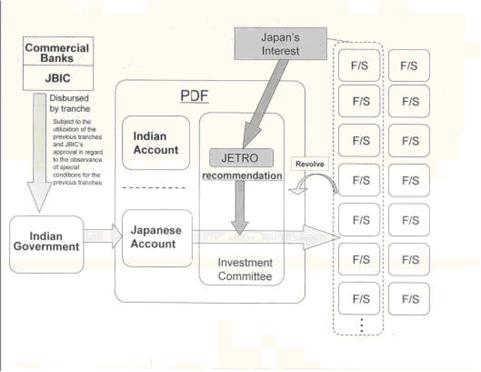

It was proposed that the DMIC PDF will have no separate legal status as it would be set up as two separate corporate accounts under the ambit of DMICDC. It was envisaged that while Government of India's fund contribution (through Grants/Loans) to PDF would be housed under a separate account of DMIC-PDF, referred as 'DMIC-PDF-Indian Account', Government of Japan's contribution (through JBIC Untied Loan) would be accommodated under DMIC-PDF-Japanese Account'.

Framework for Project Development Fund

Investment Objectives:

Project Development Fund is proposed to be a Revolving Fund aimed at investing in project preparatory activities for undertaking specific Greenfield and Brownfield industrial and physical infrastructure projects in the Delhi Mumbai Industrial Corridor (DMIC) to fund project development expenses incurred upto the stage of financial closure.

Structure of the Fund:

As part of the Project Development Fund, it is envisaged that Delhi Mumbai Industrial Corridor Development Corporation Limited (DMICDC), the project development agency for DMIC Project, shall have two separate accounts, primarily to meet the accounting requirements of JBIC funding. These accounts can be termed as

. DMIC PDF- Indian Account and

. DMIC PDF- Japanese Account.

DMIC PDF is proposed to be established with fund contribution, initially in equal proportion at overall DMIC region level, from the Governments of India and Japan. While Government of Japan's contribution will be in the form of Untied Loan by Japan Bank for International Cooperation (JBIC), Government of India's contribution will be by way of Grants (or) through budgetary sources.

The recommendations by the JETRO to the Investment Committee are needed for using funds from the Japanese Account. A project with JETRO's recommendation will be financed by the funds from the Japanese Accounts.

India Infrastructure Finance Company Limited (IIFCL), a wholly owned subsidiary of Ministry of Finance, Government of India (GOI), will borrow funds for DMIC PDF from Government of Japan through a Loan Agreement (as per the standard terms, subject to negotiation), to be executed between IIFCL and Japan Bank for International Cooperation (JBIC), on behalf of Government of Japan. Ministry of Finance, Government of India, will provide the sovereign guarantee to this loan. IIFCL is a special purpose vehicle to render long term financial assistance to infrastructure projects including roads, railways, seaports, airports, inland waterways, power, urban infrastructure, gas pipelines, SEZs and Tourism.

DMICDC will be the Sub-Borrower of this loan from IIFCL, through a separate loan agreement between IIFCL and DMICDC and accordingly will pay back interest and principal to IIFCL as per standard terms of the loan agreement, subject to negotiation.

The Project Development Fund will initially finance the preparation of overall development plan (popularly called as Master Plans) and Feasibility Studies of identified projects therein, which will be subsequently recovered by apportioning on to respective projects that would be developed by the private sector.

It is envisaged that funding resources, under PDF, shall be further used for setting up special purpose companies for projects approved by the Board of DMICDC by way of share capital, unsecured loans, convertible debt or other quasi equity structures.

Size & Denomination of the Fund:

In general, project development and advisory Expenses for Infrastructure projects would range between 0.1% and 5% depending on the size of investment and the extent of activities involved for each project (viz. Environmental Studies, Feasibility Studies/ other technical studies, Bid Documentation, Legal expenses, Supervision etc).

Considering the cost of various projects likely to be implemented in Phase I and Phase II, it was estimated that US$ 2 -2.5 billion might be required for project preparation alone. Taking 10% of it as initial seed money, it is proposed that loans to the extent of INR 1000 Crore (US$ 250 million) be raised in Indian Rupees. However, the initial size of PDF may be revised further to receipt of inputs from Master Planning Consultants, being appointed, for Phase-1A implementation of DMIC project.

Contributors to DMICDC:

. Expected form of contribution to DMIC PDF:

- Govt. of India - 50% (by way of a grant)

- Government of Japan- 50% (by way of untied loans)

- Funding from other sources such as beneficiary State Governments, Commercial Banks/ Financial Institutions/ Multilateral Agencies, shall be discussed and organized at a later stage, if required.

In this regard, premier non-banking financial institutions of the country, including IL&FS;, have already shown interest and in due course contribution is also expected from commercial banks in India as well as FIIs.

It is expected that Government of India's contribution to PDF shall be in the form of Grants/ through budgetary sources while Government of Japan's contribution to PDF will be as an untied loan from Japan Bank for International Cooperation (JBIC).

Investment Committee

It is proposed that an Investment Committee (IC) be established for managing the DMIC PDF with responsibilities to carryout identification and selection process for eligible projects and for disbursement of funds from DMIC PDF, subject to the approval by the Board of DMICDC. Investment Committee may avail external support, wherever required, for ensuring effective investment decisions.

The Investment Committee will be initially comprised of DMICDC Board members, representatives of PMC (and the State Governments) and a representative from JETRO.

Japan External Trade Organization (JETRO), upon consultations with Japanese Companies, will make necessary recommendations to the Investment Committee to reflect their requirements for infrastructure projects.

Proposed Usage of PDF:

Funds under both the Indian and Japanese Accounts of DMIC PDF, subjected to Investment Committee's authorization, JETRO's recommendations of 'Japanese interest' for availing funds from Japanese Account and the Board's approval, would be used for:

- Payment for the project preparatory/ development expenses (Master Planning/Feasibility Studies/ Environment Impact Assessment Studies/other technical studies, preparation of tender documents, Bid Process Management for selection of Consultants/Entrepreneurs, legal fees for setting up special purpose companies etc) incurred up to the stage of financial closure for specific Greenfield and Brownfield industrial, physical and social infrastructure projects in the Delhi Mumbai Industrial Corridor (DMIC);

- Payment to PMC and other external consultants;

- To fund all expenses related to functioning of DMICDC, which will be a lean organization for project planning, development and monitoring of DMIC Projects;

- Cost of land acquisition, if required for successful implementation of DMIC projects, and only from the monies available in DMIC PDF-Indian Account.

In addition, the funds under PDF will cater to all expenses related to the setting up of the PDF, syndicating contributions to the PDF, as well as its operations, including but not limited to fees and expenses of custodians, paying agent, registrar, counsel and independent accountants, and any taxes, fees or other government charges levied against the Fund.

Funds under 'DMIC PDF-Japanese Account' shall only be used for payment towards project preparatory/ development expenses, which is referred to in the first item above.

Investment Restrictions:

It is proposed that the Investment Committee would deploy the monies under the Project Development Fund, in Debt and /or Mezzanine Debt, Equity and/or Convertible Equity Instruments or in any other form.

Drawdown:

Any Loan Contribution made by the Lenders/Contributors to the account of PDF pursuant to the issuance of a Drawdown Notice would qualify as a Drawdown. Such drawdown would be utilized for initial screening expenses on projects approved by the IC.

Reports:

It is proposed that Investment Committee would provide the lender (i) annual reports including audited financial statements of the Account within 90 days of the conclusion the Company's fiscal year and (ii) quarterly reports within 45 days of the end of each quarter providing narrative and unaudited summary financial information regarding the money deployed.

Target Returns:

It is envisaged that fund investments, which mature into viable projects, would be divested in favour of potential equity holders / buyers at an appropriate premium whereas the unsecured loans / advances / debt would be repaid to the Fund with appropriate returns. All projects will be bid out on transparent basis on best price recovery model.

The extent of returns that would be offered to debt contributors of PDF will be fixed interest rates as applicable whereas returns on commercial borrowings/other contributions will be at interest rates as discussed and finalized with respective contributors/ lenders.

It is expected that the target internal rate of return net of operating expenses (including management expenses) will be about 16% to 20% per annum for equity contributions. However, the Fund cannot provide any assurance that the target returns will be achieved.

Reinvestment of Funds under PDF

Proceeds from divestment or redemption or repayment or other transfer of investments / advances received may be retained by the Investment Committee/Board of DMICDC, to take up project development activity for other such projects in DMIC Region.

Frame work for JBIC Contribution to Project Development Fund

Subsequent to the finalization of conceptual framework for DMIC, Governments of India and Japan have reaffirmed continuation of their mutual cooperation in development of DMIC and also agreed to work closely with Government of India in establishment of the Project Development Fund (PDF) by providing US$125 Million as untied loan from Japan Bank for International Cooperation (JBIC).

In this regard, the Ministry of Economy, Trade and Industry (METI), Japan has formulated a framework to avail the proposed untied loan, as contribution to PDF, for meeting with expenses related to project development activities of DMIC Projects.

Proposed Framework, By Government of Japan, for PDF Contribution

Government of Japan suggests that the Project Development Fund can be set up in the form of separate accounts, of the Delhi Mumbai Industrial Corridor Development Corporation Limited (DMICDC), as Indian Account and Japanese Account. Initiallly loan amount of US$75 million shall be taken up by DMICDC.

Government of Japan indicates that funds from the Japanese account can be used for projects with Japan's interest (or) projects that shall be planned/ developed/ implemented/ operated by Japanese consultants/firms (or) consortiums/joint ventures promoted by Japanese. Government of Japan also clarified that funds from Japanese Account of PDF should not be used for land acquisition. The other salient features of the framework include:

Account and Usage:

. The account for the proceeds of proposed untied loan shall be kept and recorded separately in the PDF, which shall have to be regularly reported to JBIC.

. The entire proceeds of the untied loan shall have to be used or the sole purposes of financing the eligible projects, as defined below.

. Revolving usage is permitted but for the eligible projects only.

Eligible Projects and other Conditions:

. Eligible projects include feasibility study (f/s), an environmental impact assessment (EIA) report and legal fees for the establishment of Special Purpose Vehicles (SPV) of those projects that would contribute to the improvement of Japanese investors' business environment ("Japan Element") in the domain of DMIC.

. As a practical procedure to ensure Japan Element, an endorsement by JETRO special advisor to DMICDC or JETRO in India shall be required in the form of "JETRO Endorsement Letter".

. Disbursement of the loan is proposed to be made in tranches based on expected financing schedule (e.g. 5 tranches, US$25 Million each). It is envisaged that each disbursement other than the first tranche is subjected to utilization of previous tranches and JBIC's approval in regard to the observance of special conditions for the previous tranches.

. The Borrower may apply the disbursed funds to the Eligible Projects without JBIC's prior approval, provided that the project information to be submitted to JBIC at the time of quarterly reporting starting immediately after the first disbursement.

. At the end of every quarter, the Borrower shall submit to JBIC (i) Project information for the newly approved projects and (ii) Statement of Expenditures for all projects. The Project information shall cover not only the summary description of the project but also the Japan Element, together with the JETRO Endorsement Letter.

. In case JBIC judges that the proceeds of this loan were applied to noneligible projects nor any other conditions (such as JBIC guidelines) are not observed, then the Borrower shall immediately prepay the funds for such projects to the Lenders, which may not-be re-lent by the Lenders.

Proposed Loan Structure:

. Lender: JBIC and co-financiers (arranged by JBIC)

. Borrower: India Infrastructure Finance Company Limited (IIFCL)

. Sub-Borrower: DMICDC

. Amount: Upto the equivalent amount of US$125 Million

. Currency: Japanese Yen or US Dollars

Envisaged JBIC Guidelines:

. "Guidelines for procurement under Untied Loans by JBIC" and "JBIC Guidelines for Confirmation of Environmental and Social Consideration" shall be observed.

. In summary, selection of contractors shall have to be made on a competitive basis. Moreover, the amount of each Eligible Project shall be less than US$12.5 Million.

Cost Streams

DMIC Project is a first ever kind of initiative that Government of India has taken up with comprehensive regional development approach. Detailed Planning exercises are critical besides developing few early bird, standlone/significant projects to promote investments in DMIC Region through private sector funding/public private partnership. It is envisaged that especially during first three years of DMIC project, DMICDC/GOI would primarily focus on undertaking requisite preparatory/development activities. Accordingly, expected cost streams for the first three years are detailed in following sections.

As part of development of Phase-1A, DMICDC/GOI already initiated some of the project preparatory activities/works during 2007-08, which would be completed during 2008-09 enabling refinement and further streamlining of project cash outflows for the financial year of 2008-09. Broad estimations are also provided the remaining two financial years of 2009 to 2011. These estimations for 2009-11 will be futher refined after completion of activities envisaged during 2008-09.

Operational Expenses

Operational Expenses for Department of Industrial Policy & Promotion, MoCI

No additional operational expenses envisaged for the DIPP to handle DMIC Project. DMIC Project will be coordinated by a Dy. Secretary under the overall guidance of the concerned Joint Secretary.

Operational Expenses for DMICDC

DMICDC is proposed to be a dedicated lean entity, with stakeholders from Government of India as well as from private sector, for the initial period of three years so as to enable the successful take-off for DMIC project. Accordingly, operational expenses for DMICDC shall be minimal, for atleast next three financial years during project development, if not negligible, compared to the amount of expenditure that would be involved in undertaking project preparatory/ project development activities. A provision for catering to such expenses is envisaged as part of project's cash out-flows.

Projected Cash Out-Flows for Project Development

Although, Government of India approved development of 12 investment nodes (consisting of 6 investment regions and 6 industrial areas) as part of Phase-1 development of DMIC Region, as this kind of mega initiative with integrated regional development approach being taken up for the first time in the country, it was decided that development activity for 6 investment regions, of Phase-1 as detailed below, and preparation of perspective plan for overall DMIC Region would be immediately taken up as part of Phase-1A.

. Dadri-Noida-Ghaziabad Investment Region in Uttar Pradesh

. Manesar-Bawal Investment Region in Haryana

. Khushkhera-Bhiwadi-Neemrana Investment Region in Rajasthan

. Ahmedabad-Dholera6 Investment Region in Gujarat

. Igatpuri-Nashik-Sinnar Investment Region in Maharashtra

. Pithampura-Dhar-Mhow Investment Region in Madhya Pradesh

Further to the completion of planning activities for overall DMIC region and six investment regions during 2008-09, at least 50-60 projects would be identified for developing through private sector funding/ public private partnership. For selected projects, there would be a requirement to carry out project structuring and bid process management for selection of private sector entrepreneurs for development, operation/management. These Projects would be taken up as part of Phase-1B during subsequent financial years i.e. 2009-10 and 2010-11.

It is also expected that project development activity for the remaining six industrial areas (IAs) of Phase-1 will be taken up as part of Phase-1B during the financial year of 2009-10.

Government of India/DMICDC also initiated project development activity for Phase-1A by issuing an Expression of Interest Notice, on 9th February, 2008, in world wide editions of 'The Economist' for selection of consultants for:

. Preparation of Perspective Plan for overall DMIC Region

. Preparation of Development Plans, with Pre-Feasibility Studies, for six investment nodes (i.e. investment regions, identified for development as part of Phase-1A)

In all, 17 top international companies/ consortiums have responded. 16 international consulting firms were qualified for category - 1 and 15 international consulting firms were qualified for category - 2 projects. Earlier RFP for category - 1 & 2 were sent to six DMIC states and the Central Infrastructure Ministries for their comments and issued to all the shortlisted consultants after incorporating comments. A prebid meeting was held on 16th of April 2008, which was attended by all the international consulting firms and consortium partners and representative from central / state governments.

After reviewing queries raised by consultant, it was decided to revise the category -1 RFP and further comments from various central / state agencies were obtained. The revised RFP for category - 1after incorporating comments was issued to 16 shortlisetd consultant. PMC received six bids from the qualified consultants on 14th August 2008 and the evaluation of the bids was completed on 16th of September 2008. . Negociation for the same is in progress and this work is expected to be awarded by end of September 2008.

Similarly, it was decided that the RFP for category - 2 should be issued node wise i.e. separartly for each node in DMIC state. This activity involved indepth involvement of state level nodal agency for comments and suggestion on preparation of development plan and include feasibility study for some of the identified early bird project. RFP for Gujarat node and Madhya Pradesh node under category -2 projects were issued on 14th of August 2008 and 19th of September 2008. PMC had received ten bids for Gujarat node development plan study and evaluation will be completed by 29th of September 2008. This work is expected to be by October 2008. Bids for Madhya Pradesh nodes are expected by 24th of October 2008 and this project shall be awared by end of November 2008. The bids for remaing four nodes i.e. Haryana, Uttar Pradesh, Rahasthan and Maharashtra shall be issued before November 2008 and these projects shall be awarded by December 2008.

Funding Requirements for Phase-1A during the financial year of 2008-09:

Based on the activities which are either already initiated and that would be taken up as part of Phase-1A, as detailed below, it is estimated that there would be a requirement of INR 100Crore (US$25 Million) for envisaged project development/preparatory activities of Phase-1A of DMIC project during 2008-09.

. Preparation of Detailed Perspective Plan for overall DMIC Region. It also involves preparation of pre-feasibility studies for five selected projects and preparation of detailed feasibility reports for selected other five projects;

. Preparation of Development Plan with pre-feasibility studies, for six investment nodes in DMIC Region. It involves preparation of detailed master plan for developing a future city of 25 to 50sqkm in each of the node, preparation of pre-feasibility studies for five selected projects and preparation of detailed feasibility reports for selected other five projects;

. Identification of stand-alone and significant projects (viz. ports, airports, expressways, logistics hubs, industrial parks. clusters, townships etc) and undertaking requisite project preparatory activities, including technical studies/feasibility assessments, environment impact assessment, project management consultancy, project marketing, and bid process management activities for elected early bird projects, for implementing through Public Private Partnership/Private Sector Participation and incorporation expenses for special purpose companies that would be formed for implemting projects of specific sectors/projects;

. Operational Expenses of DMICDC.

Acvitivity Schedule for Phase-1A:

It is envisaged Government of India/ DMICDC would primarily involve in undertaking project preparatory/development activities including planning, identification of projects, bundling/unbundling, allocation of projects to various state/central agencies, carry out bid process management for selected projects/sectors to identify private sector partners, incorporation of special purpose companies that would implement projects and assist in achieving of financial close by mobilizing funds from various sources.

Accordingly, the activity schedule for undertaking planning and development activities of Phase-1A, i.e. preparation of development plans with feasibility studies for six investment regions and preparation of detailed perspective plan for overall DMIC region as well as carry out project preparatory activities for implementation of selected early bird, stand alone projects would be as follows:

|

Activity

|

Target End Date

|

Financial Year

|

|

A. Planning and Development Activities for six investment nodes and overall

DMIC Region

|

|

Issue of EOI Notice for appointing Consultants

|

February,2008

|

2007-08

|

|

Selection and Appointment of Consultants

|

September 2008 to December 2008

|

2008-09

|

|

Preparation of Perspective Plan for DMIC Region/Development Plans for Investment Nodes and Identification of Projects

|

By July,2009

|

|

|

Feasibility Studies and Project Preparation

activities for about 10 projects each in six

investment regions and at overall DMIC Region:

|

By September,

2009

|

2009-10

|

|

Master Planning for Greenfield Integrated

Industrial Townships of 25 to 50sqkm, one in each

of six DMIC States

|

By September,

2009

|

|

|

Bid Process Management and Selection of Private

Sector Partners for setting up Special Purpose

Companies (SPCs) for select sectors/projects

|

By March, 2010

|

|

|

B. Development of Early Bird Projects as part of Phase-1A

|

|

Identification of Early Bird, Stand-alone and significant Projects

|

By August/ December, 2008

|

2008-09

|

|

Feasibility Studies and Project Preparation for Early Bird Projects

|

By December ,2009

|

|

|

Bid Process Management and Selection of Private

Sector Partners for short listed Early Bird Projects

to develop as Model Initiatives

|

By March, 2009

|

|

Funding Requirements during 2009-11:

Further to the completion of planning activities for overall DMIC region and six nvestment regions of Phase-1A during 2008-09, at least 50-60 projects would be dentified for developing through private sector funding/ public private artnership. For selected/ short listed projects, project structuring and bid process anagement activity would be carried out during 2009-11 for selection of private ector entrepreneurs for development, operation/management. Broad estimations eveal that there would be requirement for about INR 550 Crore during 2009-11 o cater to requisite activities for development of Phase-1A projects. These xpenses would also include equity contribution to the special purpose companies that would be formed for various sectors/ states (viz. textile/automobile/manufacturing parks, Highways/Expressways, Railway Linkages, ogistics Hubs, ports, airports, power generating plants, power transmission and istribution system, skill development institutes/knowledge cities, IT/Biotechnology Hubs etc in each of the state and across the DMIC Region) ased on project bundling/unbundling of Phase-1A projects for viable special purpose companies and attract private sector participation.

It is also expected that project development activity for the remaining six industrial areas (IAs), of Phase-1, would be taken up as part of Phase-1B during the financial year of 2009-10. Projects thus identified from Phase-1B investment nodes would be taken up for project preparation/development activity, during 20010-11 to implement through private sector funding/public private partnership. It is estimated there would be a requirement of INR 300 Crore for undertaking project preparatory/development activities for Phase-1B projects during 2009-11. These expenses would also include equity contribution to the special purpose companies that would be formed for various sectors/ states based on project bundling/unbundling of Phase-1B projects for viable special purpose companies and attract private sector participation.

Accordingly, the master planning/ detailed feasibility studies and other project development/preparatory activities for both Phase-1A and Phase-1B projects would involve an expenditure of about US$250 Million (i.e. INR 1000 Crore), as also detailed in the enclosed Cash Flow Statement.

It is important to note that further to completion of tasks related to project development/project preparatory activities (viz. master planning, incorporation of Special Purpose Companies) of Phase-1A during 2008-09, detailed analyses would need to be carried out for precisely assessing funding requirements for implementing various projects of Phase-1A as well as for undertaking project planning, preparation/development activities for remaining 6 nodes (industrial areas) of Phase-1 and a revised and detailed cash flow statement would need to be prepared in July,2009 based on inputs from Master Plannning Consultants.

Funding Requirements for Land Acquisition:

With respect to the cost of Land Acquisition as per the Law of Land of GOI and respective states, funds under 'DMIC PDF-Indian Account' shall only be used to partly fund the cost of land, only if essential for successful implementation of DMIC projects. It is envisaged that the primary contribution for the cost of land acquisition for DMIC Projects shall either be borne by Government of India in the form of grants on behalf of respective central government agencies or by respective industrial development corporations/ other state government agencies/through capital contribution from respective investors, who are keen to implement and manage such projects. However, as seen in the enclosed Cash Flow Statement, a provision of INR 1200 Crore has been kept for Phase-1 Projects. It would need to be revised further to obtaining of inputs from Consutlants for Phase-1A Projects.

Servicing Charges for GOJ/ JBIC's Untied Loan for PDF

As discussed above, Government of Japan has agreed to provide an Untied Loan of US$125 Million in about five tranches, depending on the progress of utilization of funds released through earlier tranches. Initially US$75 million loan shall be procured by DMICDC.

Government of Japan agreed to offer Untied Loan of about US$12.5 Million (approximately amounting to INR Fifty Crore), through JBIC, during the financial year of 2008-09. As per the estimated cash flows, Untied Loan of about US$ 50 Million (i.e. about INR 200 Crore) would be required on behalf of Government of Japan/ JBIC during the financial year of 2009-10 and US$62.5 Million during 2010-11.

It is proposed that as per the "Guidelines for procurement under Untied Loans by JBIC" and as per the "JBIC Guidelines for Confirmation of Environmental and Social Consideration" and other terms and conditions for offering Untied Loans to India, the applicable interest rate for funds offered through Untied Loan could be 1.2% with a moratorium of 3 years (during project development activity) and a repayment period of 10 years.

Considering a moratorium period of 3 years for the proposed US$12.5 Million (i.e. INR 50 Crore) JBIC's untied loan during 2008-09, no servicing charges are envisaged between 2008 and 2011.

Expenses related to Government of India's contribution to PDF

It is envisaged that Government of India would also initially contribute US$12.5 Million (i.e. about INR 50 Crore) during the financial year of 2008-09 for funding expenses related to master planning and project development. Further, there would be a requirement of INR 200 Crore (i.e. US$50Million) grant during the financial year of 2009-10 towards meeting with expenses related to Master Planning/ Project Development activities and INR 250 Crore (i.e. US$62.5Million) during 2010-11.

As Government of India's contribution to PDF (especially for undertaking project development/preparatory activities) shall be in the form of a Grant (or) through budgetary sources, hence no servicing charge is envisaged for the same.

Returns to Equity Contributors

It is envisaged that the equity contributions to the PDF would need to be ensured adequate returns to retain and/or attract further investments (atlest 16% to 20% per annum) to the PDF.

Revenue Streams for DMICDC

DMICDC is proposed to have a lean organizational structure during the project development activity, i.e especially during the first three years atleast after incorporation in January, 2008. Further, it is envisaged that once the revenue streams are established and DMICDC achieves the financial sustenance, the organizational structure would be augmented to full fledged organization. DMICDC needs to undertake preparation of a Detailed Business Plan for implementation/ management of DMIC Project to suitably define the sources and extent of possibilities for ensuring revenue generation. However, based on the understanding of project scope, following potential revenue sources are identified as a preliminary measure:

. Revenues from Project Implementation/ Management;

. Revenues through raising finances/ attracting investments, by collecting a percent share of such transactions from respective central/state government agencies;

. Revenues through provision of advisory services to undertake requisite studies for developing similar industrial corridors in India and across the World;

. Revenues through 'Success Fee', to be paid by the successful bidders identified through transparent bidding process, as a percentage share of Project Cost.

Revenue Streams through Project Implementation/ Management

DMICDC initiated the project development activity for DMIC by issuing EOI notice to appoint Consultants for preparation of detailed perspective plan for overall DMIC Region and Development Plans for six Investment Regions (IRs).

These Consultancy assignments are expected to lead to identification of wide range of industry and infrastructure initiatives across the DMIC Region. While implementation/ management of majority of projects identified under Investment Nodes would be taken care by the respective state/central government agencies, DMICDC can undertake implementation/managegment of pilot projects with reference to industry, logistics, transportation, skill development and theme township projects as follows:

. Integration of Border Check Posts and existing Toll Plazas on National/ State Highways by introducing Electronic Toll Collection System technologies;

. Introducing Intelligent Transport System (ITS) technologies for automatic vehicle tracking (GPS) system, incident management and highway information systems;

. Implementation/ Management of Expressways/ MRTS/ High SpeedCommuter Trains, Interchanges, Multi-modal Logistics Hubs etc;

. Implementation/ Management of Pilot Projects related to setting up of Ecological Industrial Parks for select industry sectors, Waste Water Recycling system, promoting usage of renewable energy, University/ Knowledge City for Manufactuing Industries, Group Power Plant with transmission system, sustainable industry development etc.

Revenue Streams through raising finances/ attracting investments

DMICDC may avail revenue streams by charging a percentage of share of such transactions, for raising requisite finances or for attracting investments in various industry and infrastructure sectors.

Revenue Streams through advisory services

DMICDC may avail revenue by offering advisory services to various state governments and other institutions across the world for conceptualizing and developing similar projects.

Revenue Streams through Success Fees

It is expected that about 75% of estimated investments in various industry and infrastructure projects of DMIC would involve Public Private Partnership framework for which there is a need to identify private sector partners through transparent bid process management. As per the prevailing practices in India and across the world, there is an immense potential that developers/ operators thus identified/ shortlisted would pay a fixed percentage of landed project cost as the Success Fee to DMICDC, the monitoring agency, as well as to the Project Development Advisor further to the issue of Letter of Award by the respective state/central government agency.

|